.png)

What is the Recovery Forecast for the Hotel Industry?

by Raksha Daryanani | February 17, 2021 | EVENTS |

The hotel sector may appear gloomy but rest assured, we’re here to deliver hope. On January 21st, we hosted our Hospitality Talks webinar with STR’s Senior Vice President of Research, Steve Hood. This article will get you updated on the hotel industry’s recent performance metrics and future insights he shared. Watch the webinar replay to hear Steve’s insights or read the summary below for key information.

We start off with an overview of the industry’s performance in 2020 in the USA and EMEA. Next, we describe the countries, regions, and activities that over-performed despite the situation, followed by the factors that will drive recovery. Lastly, we estimate when travel demand will rebound and predict when the hospitality industry will return to pre-pandemic levels.

Hospitality Industry Performance in 2020

The hospitality industry is a cyclical one where downturns are normal. Similar downturns have happened in 1994, 2001, and 2009, but were followed by a speedy recovery. Before COVID-19, e.g., people were travelling more than ever, and hospitality was experiencing a boom. Airlines were expanding their routes, new hotels were opening globally, and low-cost travel became increasingly common.

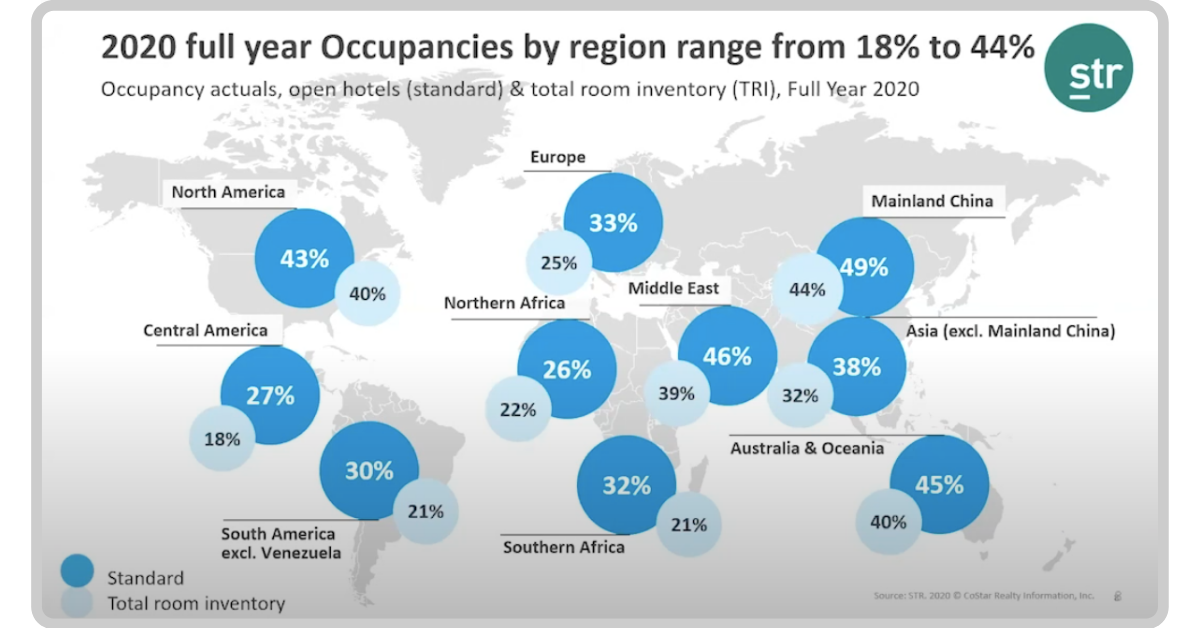

Occupancy

Although 2020 brought a shock to the hotel industry, it still had some bright spots. Overall, occupancy in regions such as China, the Middle East, and Australia was higher than others due to early border closures, severe measures, and travel bubbles. The closures in Europe significantly impacted the UK, Spain, and Italy.

Spain went from 80% open in March to about 20% during April-May 2020. Fortunately, most of their hotels reopened in August-September, resulting in a summer travel surge. Occupancy for Europe was still around 30% overall.

The USA and Mainland China fared decently with 43% and 50% occupancies respectively in the summer of 2020. Sadly, lockdown 2.0 happened in November and December 2020 and has stretched into January 2021 for many countries.

RevPAR and ADR

Europe has also been the most impacted, with a RevPAR of -72%. Most other places are below -50%, indicating a challenging year for the global hotel industry. ADR has remained relatively stable compared to occupancy. It seems that hotels are thinking about long-term profitability and keeping performance high during lockdown 2.0. They are less inclined to decrease rates, which is good news.

-png.png)

Countries, Regions, and Activities That Performed Well in 2020

While bigger cities and international travel have indeed suffered, short-haul travel, staycations, and drive to locations have boomed globally. Sanya, e.g., one of China’s top resort destinations, has had a great year. Their RevPAR percent change by December 2020 was positive, and Sanya did better in 2020 than in 2019. October 2020 was a golden week for them, with an occupancy of 90%. Overall, smaller cities in China are doing better than Beijing and Shanghai.

Another interesting sign from China has been the importance of New Year’s celebrations. Holidays like these have taken on a whole new significance, whereby luxury and upscale hotels perform well. The expectation is that these hotels will benefit from increased occupancy during the upcoming Chinese New Year.

The Middle East has been another region that did well throughout 2020, especially in December. They haven’t undergone a second lockdown, and they also benefited from a travel bubble. Australia has had a surge in domestic travel due to government promotions, vouchers, and travel bubbles.

Weekend getaways, staycations, and outdoor activities also did well in Spain and Latin America. Hotels in smaller US cities like Gatlinburg, Tennessee, and Myrtle beach have had a great year, contrary to bigger towns, e.g., Miami and Orlando. Smaller UK cities such as Liverpool and Bath have also performed decently. In the south and far east, Singapore, the Maldives, and Malaysia have performed well.

-png.png)

Factors That Will Drive Recovery

- Speed of vaccinations: Vaccine rollout has brought a sigh of relief to travellers and the hospitality industry. Travel surveys indicate that once people feel safe, they will venture out again. The hospitality sector will benefit from this pent-up demand.

- Coordination between countries on travel procedures: While the vaccine is being distributed, governments are looking into safe border reopening with advanced testing and verification methods. Apps such as Commonpass provide a promising outlook to the airline and hotel industry.

- Automation, data science, and digital guest services in hotels: Making processes such as check-in, guest relations, and communication of health and safety measures contactless will be another factor to drive recovery and increase traveller numbers.

- Big events: These are already pre-booked, and it is estimated that they will drive recovery and increase occupancy. On the list for 2021 is the UN conference, the London Marathon, England vs Scotland match, Adrian Flux British Fim, Ramstein and JLS concert, and the Dubai Expo.

- Domestic tourism: Because of their accessibility and safety, open-air, nature-based, and ‘slow’ activities are becoming the norm in smaller cities.

When Will Travel Rebound?

The first quarter of 2021 sees tiny improvements, but a more evident recovery of the hospitality industry will be seen and felt in Q2. The global events planned during this period have already caused a spike in bookings—another peak will follow during the summer months, after which travel will level off by the end of 2021. Recovery during 2021 will look different all over the world, but it still appears a bit slow.

-png.png)

When Will Hospitality Return to Pre-Pandemic Levels?

The UNWTO Panel of Experts presented three forward-looking scenarios in December 2020. Their analysis for scenario two indicates that international tourism will return to pre-pandemic levels by the end of 2023. With the vaccine rollout, improvement of traveller confidence, and lifting of travel restrictions as crucial factors. Another major factor is the recovery of the global economy.

As for metrics, demand will be the first one to recover, followed by occupancy and ADR. RevPAR will be the slowest to recover globally. In-person meetings and events will probably be the last to recover, much like business travel. Experts estimate a different recovery per region, but overall, the outlook is promising. It seems that the worst is behind us, hotels have reopened, and hotel CEOs are optimistic. For up-to-date hospitality insights, be sure to download our hospitality pulse here.

-png.png)

Join Our Next Hospitality Talks

Hospitality Talks is one of the many initiatives Hosco has put into place to support all industry stakeholders since the global health crisis started in March 2020. Our series of webinars unite industry experts so they can share their best practices, insights, and opinions about the future of hospitality. Want to watch our next Hospitality Talks webinar live?

MORE RELATED CONTENT

Ready to hire on Hosco? Create your company account.

Want to enhance your people strategy

and keep it up to date?

Subscribe to our blog.

-2.png?width=767&name=645x407%20px%20B2B_BLOG%20IMAGE%20TEMPLATE%20(3)-2.png)

.png?width=767&name=645x407%20px%20B2B_BLOG%20IMAGE%20TEMPLATE%20(8).png)